bimets is an R package developed with the aim to ease time series analysis and to build up a framework that facilitates the definition, estimation, and simulation of simultaneous equation models.

bimets does not depend on compilers or third-party software so it can be freely downloaded and installed on Linux, MS Windows(R) and Mac OsX(R), without any further requirements.

Please consider reading the package vignette, wherein there are figures and the mathematical expressions are better formatted than in html.

If you have general questions about using bimets, or for bug reports, please use the git issue tracker or write to the maintainer.

TIME SERIES

ts[[year,period]] or ts[[start]] or

ts[[start,end]], given

start<-c(year1,period1) and

end<-c(year2,period2) and ts as a time

series.ts['Date'], or multiple

observations by using ts['StartDate/EndDate'].ts[indices].STOCK, SUM, AVE, etc.)

while reducing the time series frequency.TSEXTEND(), time series merging TSMERGE(),

time series projection TSPROJECT(), lag

TSLAG(), lag differences absolute and percentage

TSDELTA() TSDELTAP(), cumulative product

CUMPROD(), cumulative sum CUMSUM(), moving

average MOVAVG(), moving sum MOVSUM(), time

series data presentation TABIT().Example:

#create ts

myTS=TIMESERIES((1:100),START=c(2000,1),FREQ='D')

myTS[1:3] #get first three obs.

myTS[[2000,14]] #get year 2000 period 14

myTS[[2032,1]] #get year 2032 period 1 (out of range)

start <- c(2000,20)

end <- c(2000,30)

myTS[[start]] #get year 2000 period 20

myTS[[start,end]] #get from year-period 2000-20 to 2000-30

myTS['2000-01-12'] #get Jan 12, 2000

myTS['2000-02-03/2000-03-04'] #get Feb 3 up to Mar 4

myTS[[2000,3]] <- pi #assign to Jan 3, 2000

myTS[[2000,42]] <- NA #assign to Feb 11, 2000

myTS[[2000,100]] <- c(-1,-2,-3) #assign array starting from period 100 (i.e. extend series)

myTS[[start]] <- NA #assign to year-period 2000-20

myTS[[start,end]] <- 3.14 #assign from year-period 2000-20 to 2000-30

myTS[[start,end]] <- -(1:11) #assign multiple values

#from year-period 2000-20 to 2000-30

myTS['2000-01-15'] <- 42 #assign to Jan 15, 2000

#aggregation/disaggregation

myMonthlyTS <- TIMESERIES(1:100,START=c(2000,1),FREQ='M')

myYearlyTS <- YEARLY(myMonthlyTS,'AVE')

myDailyTS <- DAILY(myMonthlyTS,'INTERP_CENTER')

#create and manipulate time series

myTS1 <- TIMESERIES(1:100,START=c(2000,1),FREQ='M')

myTS2 <- TIMESERIES(-(1:100),START=c(2005,1),FREQ='M')

#extend time series

myExtendedTS <- TSEXTEND(myTS1,UPTO = c(2020,4),EXTMODE = 'QUADRATIC')

#merge two time series

myMergedTS <-TSMERGE(myExtendedTS,myTS2,fun = 'SUM')

#project time series

myProjectedTS <- TSPROJECT(myMergedTS,TSRANGE = c(2004,2,2006,4))

#lag time series

myLagTS <- TSLAG(myProjectedTS,2)

#percentage delta of time series

myDeltaPTS <- TSDELTAP(myLagTS,2)

#moving average of time series

myMovAveTS <- MOVAVG(myDeltaPTS,5)

#print data

TABIT(myMovAveTS,myTS1)

# Date, Prd., myMovAveTS , myTS1

#

# Jan 2000, 1 , , 1

# Feb 2000, 2 , , 2

# Mar 2000, 3 , , 3

# ...

# Sep 2004, 9 , , 57

# Oct 2004, 10 , 3.849002 , 58

# Nov 2004, 11 , 3.776275 , 59

# Dec 2004, 12 , 3.706247 , 60

# Jan 2005, 1 , 3.638771 , 61

# Feb 2005, 2 , 3.573709 , 62

# Mar 2005, 3 , 3.171951 , 63

# Apr 2005, 4 , 2.444678 , 64

# May 2005, 5 , 1.730393 , 65

# Jun 2005, 6 , 1.028638 , 66

# Jul 2005, 7 , 0.3389831 , 67

# Aug 2005, 8 , 0 , 68

# Sep 2005, 9 , 0 , 69

# Oct 2005, 10 , 0 , 70

# ...

# Mar 2008, 3 , , 99

# Apr 2008, 4 , , 100 More details are available in the reference manual.

MODELING:

bimets econometric modeling capabilities comprehend:

character R variable with a specific syntax. Collectively,

these keyword statements constitute a kind of a bimets

Model Description Language (i.e. MDL). The MDL syntax

allows the definition of behavioral equations, technical equations,

conditional evaluations during the simulation, and other model

properties.ESTIMATE() supports Ordinary Least Squares, Instrumental

Variables, deterministic linear restrictions on the coefficients, Almon

Polynomial Distributed Lags (i.e. PDL), autocorrelation of

the errors, structural stability analysis (Chow tests).SIMULATE() supports static, dynamic and forecast

simulations, residuals check, partial or total exogenization of

endogenous variables, constant adjustment of endogenous variables

(i.e. add-factors).TSLEAD

function in theirs equations applied to an endogenous variable;

Forward-looking models assume that economic agents have complete

knowledge of an economic system and calculate the future value of

economic variables correctly according to that knowledge. Thus,

forward-looking models are called also rational expectations models and,

in macro-econometric models, model-consistent expectations.STOCHSIMULATE() the structural disturbances are

given values that have specified stochastic properties. The error terms

of the estimated behavioral equation of the model are appropriately

perturbed. Identity equations and exogenous variables can be as well

perturbed by disturbances that have specified stochastic properties. The

model is then solved for each data set with different values of the

disturbances. Finally, mean and standard deviation are computed for each

simulated endogenous variable.MULTMATRIX() computes the matrix of both impact

and interim multipliers for a selected set of endogenous variables,

i.e. the TARGET, with respect to a selected set of

exogenous variables, i.e. the INSTRUMENT.RENORM() performs the endogenous targeting of econometric

models, which consists of solving the model while interchanging the role

of one or more endogenous variables with an equal number of exogenous

variables. The procedure determines the values for the

INSTRUMENT exogenous variables that allow achieving the

desired values for the TARGET endogenous variables, subject

to the constraints given by the equations of the model. This is an

approach to economic and monetary policy analysis.A Klein’s model example, having restrictions, error autocorrelation, and conditional evaluations, follows. For more realistic scenarios, several advanced econometric exercises on the US Federal Reserve FRB/US econometric model (e.g., dynamic simulation in a monetary policy shock, rational expectations, endogenous targeting, stochastic simulation, etc.) are available in the “US Federal Reserve quarterly model (FRB/US) in R with bimets” vignette:

# MODEL DEFINITION AND LOADING #################################################

#define the Klein model

klein1.txt <- "MODEL

COMMENT> Modified Klein Model 1 of the U.S. Economy with PDL,

COMMENT> autocorrelation on errors, restrictions, and conditional equation evaluations

COMMENT> Consumption with autocorrelation on errors

BEHAVIORAL> cn

TSRANGE 1923 1 1940 1

EQ> cn = a1 + a2*p + a3*TSLAG(p,1) + a4*(w1+w2)

COEFF> a1 a2 a3 a4

ERROR> AUTO(2)

COMMENT> Investment with restrictions

BEHAVIORAL> i

TSRANGE 1923 1 1940 1

EQ> i = b1 + b2*p + b3*TSLAG(p,1) + b4*TSLAG(k,1)

COEFF> b1 b2 b3 b4

RESTRICT> b2 + b3 = 1

COMMENT> Demand for Labor with PDL

BEHAVIORAL> w1

TSRANGE 1923 1 1940 1

EQ> w1 = c1 + c2*(y+t-w2) + c3*TSLAG(y+t-w2,1) + c4*time

COEFF> c1 c2 c3 c4

PDL> c3 1 2

COMMENT> Gross National Product

IDENTITY> y

EQ> y = cn + i + g - t

COMMENT> Profits

IDENTITY> p

EQ> p = y - (w1+w2)

COMMENT> Capital Stock with IF switches

IDENTITY> k

EQ> k = TSLAG(k,1) + i

IF> i > 0

IDENTITY> k

EQ> k = TSLAG(k,1)

IF> i <= 0

END"

#load the model

kleinModel <- LOAD_MODEL(modelText = klein1.txt)

# Loading model: "klein1.txt"...

# Analyzing behaviorals...

# Analyzing identities...

# Optimizing...

# Loaded model "klein1.txt":

# 3 behaviorals

# 3 identities

# 12 coefficients

# ...LOAD MODEL OK

kleinModel$behaviorals$cn

# $eq

# [1] "cn=a1+a2*p+a3*TSLAG(p,1)+a4*(w1+w2)"

#

# $eqCoefficientsNames

# [1] "a1" "a2" "a3" "a4"

#

# $eqComponentsNames

# [1] "cn" "p" "w1" "w2"

#

# $tsrange

# [1] 1925 1 1941 1

#

# $eqRegressorsNames

# [1] "1" "p" "TSLAG(p,1)" "(w1+w2)"

#

# $eqSimExp

# expression(cn[2,]=cn__ADDFACTOR[2,]+cn__a1+cn__a2*p[2,]+cn__a3*...

#

# ...and more

kleinModel$incidence_matrix

# cn i w1 y p k

# cn 0 0 1 0 1 0

# i 0 0 0 0 1 0

# w1 0 0 0 1 0 0

# y 1 1 0 0 0 0

# p 0 0 1 1 0 0

# k 0 1 0 0 0 0

#define data

kleinModelData <- list(

cn =TIMESERIES(39.8,41.9,45,49.2,50.6,52.6,55.1,56.2,57.3,57.8,

55,50.9,45.6,46.5,48.7,51.3,57.7,58.7,57.5,61.6,65,69.7,

START=c(1920,1),FREQ=1),

g =TIMESERIES(4.6,6.6,6.1,5.7,6.6,6.5,6.6,7.6,7.9,8.1,9.4,10.7,

10.2,9.3,10,10.5,10.3,11,13,14.4,15.4,22.3,

START=c(1920,1),FREQ=1),

i =TIMESERIES(2.7,-.2,1.9,5.2,3,5.1,5.6,4.2,3,5.1,1,-3.4,-6.2,

-5.1,-3,-1.3,2.1,2,-1.9,1.3,3.3,4.9,

START=c(1920,1),FREQ=1),

k =TIMESERIES(182.8,182.6,184.5,189.7,192.7,197.8,203.4,207.6,

210.6,215.7,216.7,213.3,207.1,202,199,197.7,199.8,

201.8,199.9,201.2,204.5,209.4,

START=c(1920,1),FREQ=1),

p =TIMESERIES(12.7,12.4,16.9,18.4,19.4,20.1,19.6,19.8,21.1,21.7,

15.6,11.4,7,11.2,12.3,14,17.6,17.3,15.3,19,21.1,23.5,

START=c(1920,1),FREQ=1),

w1 =TIMESERIES(28.8,25.5,29.3,34.1,33.9,35.4,37.4,37.9,39.2,41.3,

37.9,34.5,29,28.5,30.6,33.2,36.8,41,38.2,41.6,45,53.3,

START=c(1920,1),FREQ=1),

y =TIMESERIES(43.7,40.6,49.1,55.4,56.4,58.7,60.3,61.3,64,67,57.7,

50.7,41.3,45.3,48.9,53.3,61.8,65,61.2,68.4,74.1,85.3,

START=c(1920,1),FREQ=1),

t =TIMESERIES(3.4,7.7,3.9,4.7,3.8,5.5,7,6.7,4.2,4,7.7,7.5,8.3,5.4,

6.8,7.2,8.3,6.7,7.4,8.9,9.6,11.6,

START=c(1920,1),FREQ=1),

time=TIMESERIES(NA,-10,-9,-8,-7,-6,-5,-4,-3,-2,-1,0,

1,2,3,4,5,6,7,8,9,10,

START=c(1920,1),FREQ=1),

w2 =TIMESERIES(2.2,2.7,2.9,2.9,3.1,3.2,3.3,3.6,3.7,4,4.2,4.8,

5.3,5.6,6,6.1,7.4,6.7,7.7,7.8,8,8.5,

START=c(1920,1),FREQ=1)

);

kleinModel <- LOAD_MODEL_DATA(kleinModel,kleinModelData)

# Load model data "kleinModelData" into model "klein1.txt"...

# ...LOAD MODEL DATA OK

# MODEL ESTIMATION #############################################################

kleinModel <- ESTIMATE(kleinModel)

#.CHECK_MODEL_DATA(): warning, there are undefined values in time series "time".

#

#Estimate the Model klein1.txt:

#the number of behavioral equations to be estimated is 3.

#The total number of coefficients is 13.

#

#_________________________________________

#

#BEHAVIORAL EQUATION: cn

#Estimation Technique: OLS

#Autoregression of Order 2 (Cochrane-Orcutt procedure)

#

#Convergence was reached in 6 / 20 iterations.

#

#

#cn = 14.82685

# T-stat. 7.608453 ***

#

# + 0.2589094 p

# T-stat. 2.959808 *

#

# + 0.01423821 TSLAG(p,1)

# T-stat. 0.1735191

#

# + 0.8390274 (w1+w2)

# T-stat. 14.67959 ***

#

#ERROR STRUCTURE: AUTO(2)

#

#AUTOREGRESSIVE PARAMETERS:

#Rho Std. Error T-stat.

# 0.2542111 0.2589487 0.9817045

#-0.05250591 0.2593578 -0.2024458

#

#

#STATs:

#R-Squared : 0.9826778

#Adjusted R-Squared : 0.9754602

#Durbin-Watson Statistic : 2.256004

#Sum of squares of residuals : 8.071633

#Standard Error of Regression : 0.8201439

#Log of the Likelihood Function : -18.32275

#F-statistic : 136.1502

#F-probability : 3.873514e-10

#Akaike's IC : 50.6455

#Schwarz's IC : 56.8781

#Mean of Dependent Variable : 54.29444

#Number of Observations : 18

#Number of Degrees of Freedom : 12

#Current Sample (year-period) : 1923-1 / 1940-1

#

#

#Signif. codes: *** 0.001 ** 0.01 * 0.05

#

#

# ...similar output for all the regressions.

# MODEL SIMULATION #############################################################

#simulate GNP in 1925-1930

kleinModel <- SIMULATE(kleinModel,

TSRANGE=c(1925,1,1930,1),

simIterLimit = 100)

# Simulation: 100.00%

# ...SIMULATE OK

#print simulated GNP

TABIT(kleinModel$simulation$y)

#

# Date, Prd., kleinModel$simulation$y

#

# 1925, 1 , 58.24584

# 1926, 1 , 44.56501

# 1927, 1 , 28.2727

# 1928, 1 , 27.10598

# 1929, 1 , 37.57604

# 1930, 1 , 37.44899

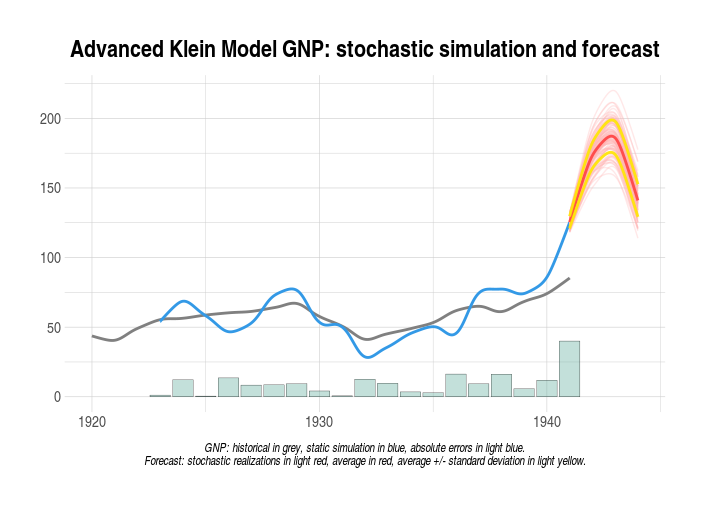

# MODEL STOCHASTIC FORECAST ####################################################

#we want to perform a stochastic forecast of the GNP up to 1944

#we will add normal disturbances to endogenous Consumption 'cn'

#in 1942 by using its regression standard error

#we will add uniform disturbances to exogenous Government Expenditure 'g'

#in whole TSRANGE

myStochStructure <- list(

cn=list(

TSRANGE=c(1942,1,1942,1),

TYPE='NORM',

PARS=c(0,kleinModel$behaviorals$cn$statistics$StandardErrorRegression)

),

g=list(

TSRANGE=TRUE,

TYPE='UNIF',

PARS=c(-1,1)

)

)

#we need to extend exogenous variables up to 1944

kleinModel$modelData <- within(kleinModel$modelData,{

w2 = TSEXTEND(w2, UPTO=c(1944,1),EXTMODE='CONSTANT')

t = TSEXTEND(t, UPTO=c(1944,1),EXTMODE='LINEAR')

g = TSEXTEND(g, UPTO=c(1944,1),EXTMODE='CONSTANT')

k = TSEXTEND(k, UPTO=c(1944,1),EXTMODE='LINEAR')

time = TSEXTEND(time,UPTO=c(1944,1),EXTMODE='LINEAR')

})

#stochastic model forecast

kleinModel <- STOCHSIMULATE(kleinModel

,simType='FORECAST'

,TSRANGE=c(1941,1,1944,1)

,StochStructure=myStochStructure

,StochSeed=123

)

#print mean and standard deviation of forecasted GNP

with(kleinModel$stochastic_simulation,TABIT(y$mean, y$sd))

# Date, Prd., y$mean , y$sd

#

# 1941, 1 , 125.5045 , 4.250935

# 1942, 1 , 173.2946 , 9.2632

# 1943, 1 , 185.9602 , 11.87774

# 1944, 1 , 141.0807 , 11.6973

# MODEL MULTIPLIERS ###########################################################

#get multiplier matrix in 1941

kleinModel <- MULTMATRIX(kleinModel,

TSRANGE=c(1941,1,1941,1),

INSTRUMENT=c('w2','g'),

TARGET=c('cn','y'),

simIterLimit = 100)

# Multiplier Matrix: 100.00%

# ...MULTMATRIX OK

kleinModel$MultiplierMatrix

# w2_1 g_1

#cn_1 0.2338194 3.753277

#y_1 -0.2002040 7.444930

# MODEL ENDOGENOUS TARGETING ###################################################

#we want an arbitrary value on Consumption of 66 in 1940 and 78 in 1941

#we want an arbitrary value on GNP of 77 in 1940 and 98 in 1941

kleinTargets <- list(

cn = TIMESERIES(66,78,START=c(1940,1),FREQ=1),

y = TIMESERIES(77,98,START=c(1940,1),FREQ=1)

)

#Then, we can perform the model endogenous targeting

#by using Government Wage Bill 'w2'

#and Government Expenditure 'g' as

#INSTRUMENT in the years 1940 and 1941:

kleinModel <- RENORM(kleinModel

,simConvergence=1e-5

,INSTRUMENT = c('w2','g')

,TARGET = kleinTargets

,TSRANGE = c(1940,1,1941,1)

,simIterLimit = 100

)

# Convergence reached in 3 iterations.

# ...RENORM OK

#The calculated values of exogenous INSTRUMENT

#that allow achieving the desired endogenous TARGET values

#are stored into the model:

with(kleinModel,TABIT(modelData$w2,

renorm$INSTRUMENT$w2,

modelData$g,

renorm$INSTRUMENT$g))

# Date, Prd., modelData$w2, renorm$w2, modelData$g, renorm$g

#

# ...

#

# 1938, 1 , 7.7 , , 13 ,

# 1939, 1 , 7.8 , , 14.4 ,

# 1940, 1 , 8 , 5.577777 , 15.4 , 14.14058

# 1941, 1 , 8.5 , 5.354341 , 22.3 , 17.80586

#So, if we want to achieve on "cn" (Consumption) an arbitrary simulated value of 66 in 1940

#and 78 in 1941, and if we want to achieve on "y" (GNP) an arbitrary simulated value of 77

#in 1940 and 98 in 1941, we need to change exogenous "w2" (Wage Bill of the Government

#Sector) from 8 to 5.58 in 1940 and from 8.5 to 5.35 in 1941, and we need to change exogenous

#"g"(Government Expenditure) from 15.4 to 14.14 in 1940 and from 22.3 to 17.81 in 1941.

#Let's verify:

#create a new model

kleinRenorm <- kleinModel

#update the required INSTRUMENT

kleinRenorm$modelData <- kleinRenorm$renorm$modelData

#simulate the new model

kleinRenorm <- SIMULATE(kleinRenorm

,TSRANGE=c(1940,1,1941,1)

,simConvergence=1e-4

,simIterLimit=100

)

#Simulation: 100.00%

#...SIMULATE OK

#verify TARGETs are achieved

with(kleinRenorm$simulation,

TABIT(cn,y)

)

# Date, Prd., cn , y

#

# 1940, 1 , 65.99977 , 76.9996

# 1941, 1 , 77.99931 , 97.99879

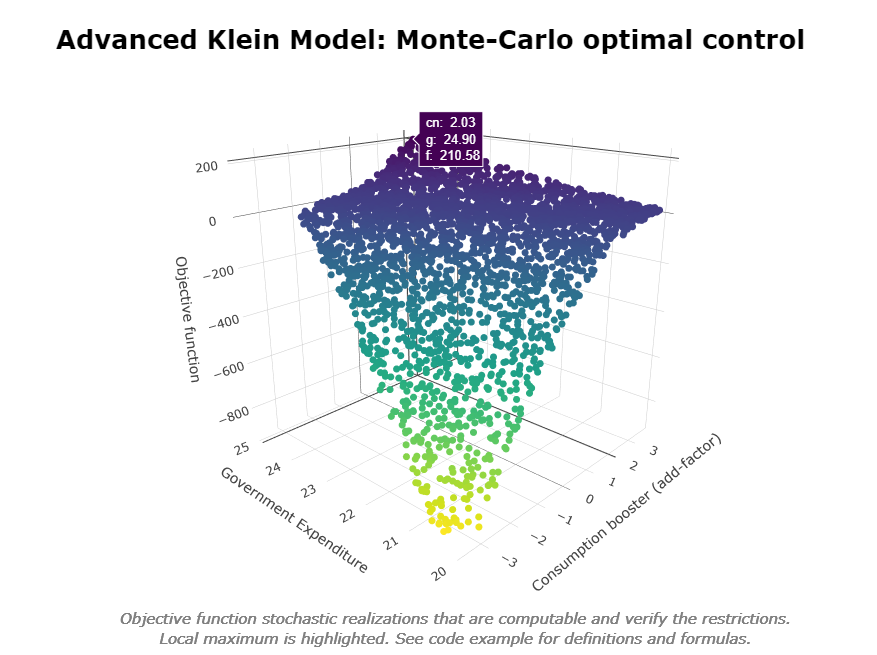

# MODEL OPTIMAL CONTROL ########################################################

#reset time series data in model

kleinModel <- LOAD_MODEL_DATA(kleinModel

,kleinModelData

,quietly = TRUE)

#we want to maximize the non-linear objective function:

#f()=(y-110)+(cn-90)*ABS(cn-90)-(g-20)^0.5

#in 1942 by using INSTRUMENT cn in range (-5,5)

#(cn is endogenous so we use the add-factor)

#and g in range (15,25)

#we will also impose the following non-linear restriction:

#g+(cn^2)/2<27 & g+cn>17

#we need to extend exogenous variables up to 1942

kleinModel$modelData <- within(kleinModel$modelData,{

w2 = TSEXTEND(w2, UPTO = c(1942,1), EXTMODE = 'CONSTANT')

t = TSEXTEND(t, UPTO = c(1942,1), EXTMODE = 'LINEAR')

g = TSEXTEND(g, UPTO = c(1942,1), EXTMODE = 'CONSTANT')

k = TSEXTEND(k, UPTO = c(1942,1), EXTMODE = 'LINEAR')

time = TSEXTEND(time, UPTO = c(1942,1), EXTMODE = 'LINEAR')

})

#define INSTRUMENT and boundaries

myOptimizeBounds <- list(

cn = list( TSRANGE = TRUE

,BOUNDS = c(-5,5)),

g = list( TSRANGE = TRUE

,BOUNDS = c(15,25))

)

#define restrictions

myOptimizeRestrictions <- list(

myRes1=list(

TSRANGE = TRUE

,INEQUALITY = 'g+(cn^2)/2<27 & g+cn>17')

)

#define objective function

myOptimizeFunctions <- list(

myFun1 = list(

TSRANGE = TRUE

,FUNCTION = '(y-110)+(cn-90)*ABS(cn-90)-(g-20)^0.5')

)

#Monte-Carlo optimization by using 10.000 stochastic realizations

#and 1E-7 convergence criterion

kleinModel <- OPTIMIZE(kleinModel

,simType = 'FORECAST'

,TSRANGE=c(1942,1,1942,1)

,simConvergence= 1E-7

,simIterLimit = 100

,StochReplica = 10000

,StochSeed = 123

,OptimizeBounds = myOptimizeBounds

,OptimizeRestrictions = myOptimizeRestrictions

,OptimizeFunctions = myOptimizeFunctions

,quietly = TRUE)

#print local maximum

kleinModel$optimize$optFunMax

#[1] 210.577

#print INSTRUMENT that allow local maximum to be achieved

kleinModel$optimize$INSTRUMENT

#$cn

#Time Series:

#Start = 1942

#End = 1942

#Frequency = 1

#[1] 2.032203

#

#$g

#Time Series:

#Start = 1942

#End = 1942

#Frequency = 1

#[1] 24.89773

# RATIONAL EXPECTATIONS ########################################################

# EXAMPLE OF FORWARD-LOOKING KLEIN-LIKE MODEL

# HAVING RATIONAL EXPECTATION ON INVESTMENTS

#define model

kleinLeadModelDefinition<-

"MODEL

COMMENT> Klein Model 1 of the U.S. Economy

COMMENT> Consumption

BEHAVIORAL> cn

TSRANGE 1921 1 1941 1

EQ> cn = a1 + a2*p + a3*TSLAG(p,1) + a4*(w1+w2)

COEFF> a1 a2 a3 a4

COMMENT> Investment with TSLEAD

IDENTITY> i

EQ> i = (MOVAVG(i,2)+TSLEAD(i))/2

COMMENT> Demand for Labor

BEHAVIORAL> w1

TSRANGE 1921 1 1941 1

EQ> w1 = c1 + c2*(y+t-w2) + c3*TSLAG(y+t-w2,1) + c4*time

COEFF> c1 c2 c3 c4

COMMENT> Gross National Product

IDENTITY> y

EQ> y = cn + i + g - t

COMMENT> Profits

IDENTITY> p

EQ> p = y - (w1+w2)

COMMENT> Capital Stock

IDENTITY> k

EQ> k = TSLAG(k,1) + i

END"

#define model data

kleinLeadModelData<-list(

cn

=TIMESERIES(39.8,41.9,45,49.2,50.6,52.6,55.1,56.2,57.3,57.8,55,50.9,

45.6,46.5,48.7,51.3,57.7,58.7,57.5,61.6,65,69.7,

START=c(1920,1),FREQ=1),

g

=TIMESERIES(4.6,6.6,6.1,5.7,6.6,6.5,6.6,7.6,7.9,8.1,9.4,10.7,10.2,9.3,10,

10.5,10.3,11,13,14.4,15.4,22.3,

START=c(1920,1),FREQ=1),

i

=TIMESERIES(2.7,-.2,1.9,5.2,3,5.1,5.6,4.2,3,5.1,1,-3.4,-6.2,-5.1,-3,-1.3,

2.1,2,-1.9,1.3,3.3,4.9,

START=c(1920,1),FREQ=1),

k

=TIMESERIES(182.8,182.6,184.5,189.7,192.7,197.8,203.4,207.6,210.6,215.7,

216.7,213.3,207.1,202,199,197.7,199.8,201.8,199.9,

201.2,204.5,209.4,

START=c(1920,1),FREQ=1),

p

=TIMESERIES(12.7,12.4,16.9,18.4,19.4,20.1,19.6,19.8,21.1,21.7,15.6,11.4,

7,11.2,12.3,14,17.6,17.3,15.3,19,21.1,23.5,

START=c(1920,1),FREQ=1),

w1

=TIMESERIES(28.8,25.5,29.3,34.1,33.9,35.4,37.4,37.9,39.2,41.3,37.9,34.5,

29,28.5,30.6,33.2,36.8,41,38.2,41.6,45,53.3,

START=c(1920,1),FREQ=1),

y

=TIMESERIES(43.7,40.6,49.1,55.4,56.4,58.7,60.3,61.3,64,67,57.7,50.7,41.3,

45.3,48.9,53.3,61.8,65,61.2,68.4,74.1,85.3,

START=c(1920,1),FREQ=1),

t

=TIMESERIES(3.4,7.7,3.9,4.7,3.8,5.5,7,6.7,4.2,4,7.7,7.5,8.3,5.4,6.8,7.2,

8.3,6.7,7.4,8.9,9.6,11.6,

START=c(1920,1),FREQ=1),

time

=TIMESERIES(NA,-10,-9,-8,-7,-6,-5,-4,-3,-2,-1,0,1,2,3,4,5,6,7,8,9,10,

START=c(1920,1),FREQ=1),

w2

=TIMESERIES(2.2,2.7,2.9,2.9,3.1,3.2,3.3,3.6,3.7,4,4.2,4.8,5.3,5.6,6,6.1,

7.4,6.7,7.7,7.8,8,8.5,

START=c(1920,1),FREQ=1)

)

#load model and model data

kleinLeadModel<-LOAD_MODEL(modelText=kleinLeadModelDefinition)

kleinLeadModel<-LOAD_MODEL_DATA(kleinLeadModel,kleinLeadModelData)

#estimate model

kleinLeadModel<-ESTIMATE(kleinLeadModel, quietly = TRUE)

#set expected value of 2 for Investment in 1931

#(note that simulation TSRANGE spans up to 1930)

kleinLeadModel$modelData$i[[1931,1]]<-2

#simulate model

kleinLeadModel<-SIMULATE(kleinLeadModel

,TSRANGE=c(1924,1,1930,1))

#print simulated investments

TABIT(kleinLeadModel$simulation$i)

#Date, Prd., kleinLeadModel$simulation$i

#

# 1924, 1 , 3.594946

# 1925, 1 , 2.792062

# 1926, 1 , 2.390277

# 1927, 1 , 2.189125

# 1928, 1 , 2.08838

# 1929, 1 , 2.037915

# 1930, 1 , 2.012644

MODEL DESCRIPTION LANGUAGE SYNTAX

The mathematical expression available for use in model equations can include the standard arithmetic operators, parentheses and the following MDL functions:

TSLAG(ts,i): lag the ts time series by i-periods;TSLEAD(ts,i): lead the ts time series by

i-periods;TSDELTA(ts,i): i-periods difference of the ts time

series;TSDELTAP(ts,i): i-periods percentage difference of the

ts time series;TSDELTALOG(ts,i): i-periods logarithmic difference of

the ts time series;MOVAVG(ts,i): i-periods moving average of the ts time

series;MOVSUM(ts,i): i-periods moving sum of the ts time

series;LOG(ts): log of the ts time series;EXP(ts): exponential of the ts time series;ABS(ts): absolute values of the ts time series.Transformations of the dependent variable are allowed in

EQ> definition, e.g. TSDELTA(cn)=...,

EXP(i)=..., TSDELTALOG(y)=..., etc.

More details are available in the reference manual.

COMPUTATIONAL DETAILS

The iterative simulation procedure is the most time-consuming operation of the bimets package. For small models, this operation is quite immediate; on the other hand, the simulation of models that count hundreds of equations could last for minutes, especially if the requested operation involves a parallel simulation having hundreds of realizations per equation. This could be the case for the endogenous targeting, the stochastic simulation and the optimal control. In these cases, a Newton-Raphson algorithm can speed up the execution.

The SIMULATE code has been optimized in order to

minimize the execution time in these cases. In terms of computational

efficiency, the procedure takes advantage of the fact that multiple

datasets are bound together in matrices, therefore in order to achieve a

global convergence, the iterative simulation algorithm is executed once

for all perturbed datasets. This solution can be viewed as a sort of a

SIMD (i.e. Single Instruction Multiple Data) parallel simulation: the

SIMULATE algorithm transforms time series into matrices and

consequently can easily bind multiple datasets by column. At the same

time, the single run ensures a fast code execution, while each column in

the output matrices represents a stochastic or perturbed

realization.

The above approach is even faster if R has been compiled and linked to optimized multi-threaded numerical libraries, e.g. Intel(R) MKL, OpenBlas, Microsoft(R) R Open, etc.

Finally, model equations are pre-fetched into sorted R expressions,

and an optimized R environment is defined and reserved to the

SIMULATE algorithm; this approach removes the overhead

usually caused by expression parsing and by the R looking

for variables inside nested environments.

bimets estimation and simulation results have been compared to the output results of leading commercial econometric software by using several large and complex models.

The models used in the comparison have more than:

In these models, we can find equations with restricted coefficients, polynomial distributed lags, error autocorrelation, and conditional evaluation of technical identities; all models have been simulated in static, dynamic, and forecast mode, with exogenization and constant adjustments of endogenous variables, through the use of bimets capabilities.

In the +800 endogenous simulated time series over the +20 simulated

periods (i.e. more than 16.000 simulated observations), the average

percentage difference between bimets and leading

commercial software results has a magnitude of 10E-7 %. The

difference between results calculated by using different commercial

software has the same average magnitude.

Several advanced econometric exercises on the US Federal Reserve FRB/US econometric model (e.g., dynamic simulation in a monetary policy shock, rational expectations, endogenous targeting, stochastic simulation, etc.) are available in the “US Federal Reserve quarterly model (FRB/US) in R with bimets” vignette.

The package can be installed and loaded in R with the following commands:

install.packages("bimets")

library(bimets)We welcome contributions to the bimets package. In the case, please use the git issue tracker or write to the maintainer.

The bimets package is licensed under the GPL-3.

Disclaimer: The views and opinions expressed in these pages are those of the authors and do not necessarily reflect the official policy or position of the Bank of Italy. Examples of analysis performed within these pages are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of the Bank of Italy.